As February 2026 approaches, many taxpayers across the United States are closely following news about a possible $2,000 IRS direct deposit. With household budgets still under pressure from higher living costs, any federal payment can make a meaningful difference. Because online discussions often mix confirmed details with assumptions, understanding how such a payment would work is important for avoiding confusion and setting realistic expectations.

Understanding the Purpose of the $2,000 IRS Deposit

The proposed $2,000 payment is described as a targeted federal benefit rather than a universal payment for all taxpayers. It is intended to support eligible individuals and households who meet specific requirements tied to tax filings, income levels, and certain credits or relief provisions. Unlike regular monthly benefits, this payment is connected to tax-related eligibility and is managed by the Internal Revenue Service. Its main goal is to provide financial support to those who qualify under federal rules.

Who May Qualify for the Payment

Eligibility for the $2,000 deposit depends largely on proper tax filing and income thresholds. Taxpayers must have filed required tax returns and provided accurate personal information, including valid Social Security numbers. Individuals who qualify for certain refundable credits or relief programs may also fall within the eligible group. Filing returns correctly and on time plays a key role in determining whether a payment can be issued without delays.

How the Payment Is Expected to Be Sent

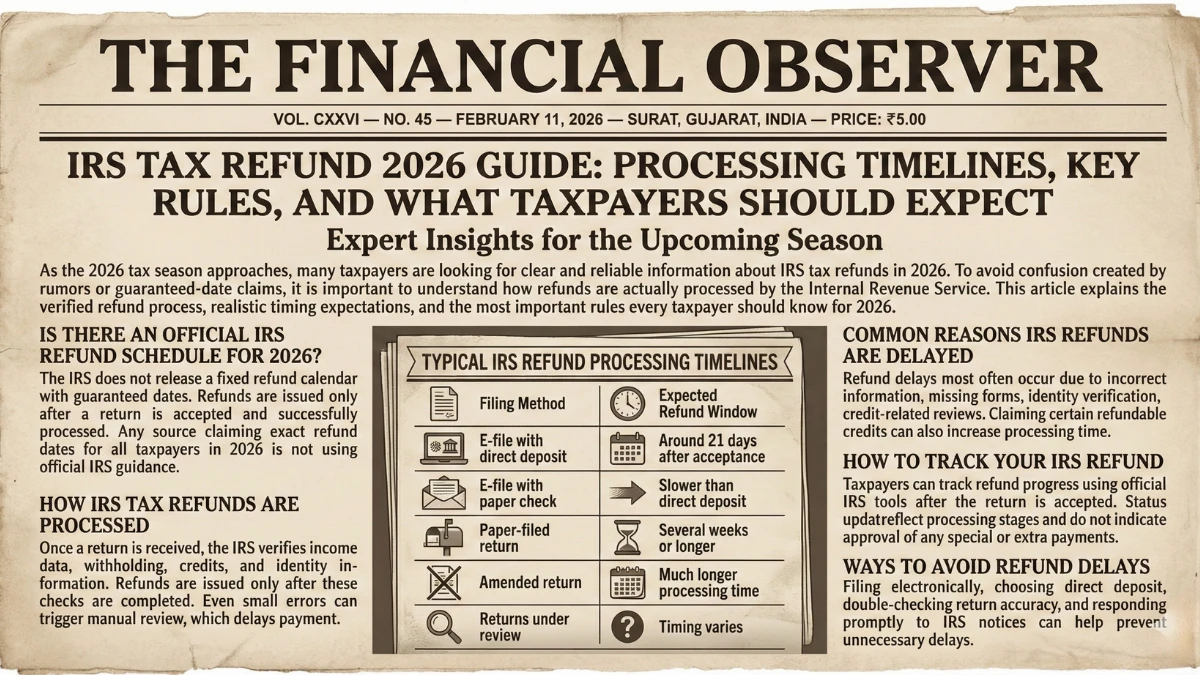

The IRS plans to issue these payments mainly through direct deposit, which is the fastest and most secure delivery method. Taxpayers who already have bank account information on file with the IRS are expected to receive payments more quickly. Those without direct deposit details may receive funds through mailed checks or prepaid debit cards, which usually take longer due to processing and postal delivery times.

Possible Reasons for Payment Delays

Although many payments are expected to arrive smoothly, delays can happen. Incorrect bank information, incomplete personal details, or pending eligibility reviews can slow processing. Amended returns or claims involving special tax credits may also require additional review time. Keeping banking and contact information updated with the IRS can help reduce these issues.

Tracking Your Payment Status

Taxpayers can monitor the status of their payment using official IRS tracking tools, including online portals and mobile services. By entering basic details such as Social Security number and filing status, individuals can see updates and better plan their monthly expenses.

Planning Ahead for February 2026

If issued, the $2,000 IRS direct deposit scheduled for February 2026 could offer important financial relief for eligible taxpayers. Staying informed, filing taxes accurately, and using official IRS tools can help ensure a smoother process and reduce unnecessary stress.

Disclaimer:

This article is for informational purposes only and does not provide financial, tax, or legal advice. IRS payment amounts, eligibility rules, and payment dates may change based on official announcements and individual tax circumstances. Readers should rely on official IRS sources for the most accurate and up-to-date information.