As February 2026 approaches, many Americans are searching for clear answers about the $2,000 federal deposit and whether they qualify to receive it. Online discussions often create confusion by presenting incomplete or misleading details. Understanding the official eligibility rules and how the payment is issued can help taxpayers know what to expect and avoid unnecessary stress.

What the February 2026 $2,000 Federal Deposit Is

The $2,000 federal deposit scheduled for February 2026 is a targeted payment connected to federal tax records. It is not a universal payment for all citizens. The deposit is intended to support eligible individuals and households who meet specific income and tax filing requirements. The payment is processed by the Internal Revenue Service using information already available in its systems, which helps ensure faster and more secure delivery.

Basic Eligibility Requirements

Qualification for the $2,000 deposit depends primarily on income level and tax filing status. Individuals and families must fall within federally defined income limits to be considered eligible. Taxpayers must also have filed the required tax returns for recent years. Those who did not file or whose filings are incomplete may not receive the payment until their records are updated and reviewed.

Importance of Accurate Tax Information

Accurate personal and financial information plays a major role in eligibility. The IRS relies on Social Security numbers, filing status, and reported income to determine who qualifies. Errors such as incorrect personal details, missing information, or mismatched income records can delay or prevent payment. Ensuring that tax returns are correct and up to date increases the chances of smooth processing.

How the Payment Will Be Sent

For most eligible taxpayers, the $2,000 deposit will be sent automatically through direct deposit. This method is used because it is faster and reduces the risk of lost or delayed payments. The funds will be deposited into the bank account already linked to IRS records. Taxpayers who do not have banking information on file may receive the payment by mailed check or prepaid debit card, which can take additional time.

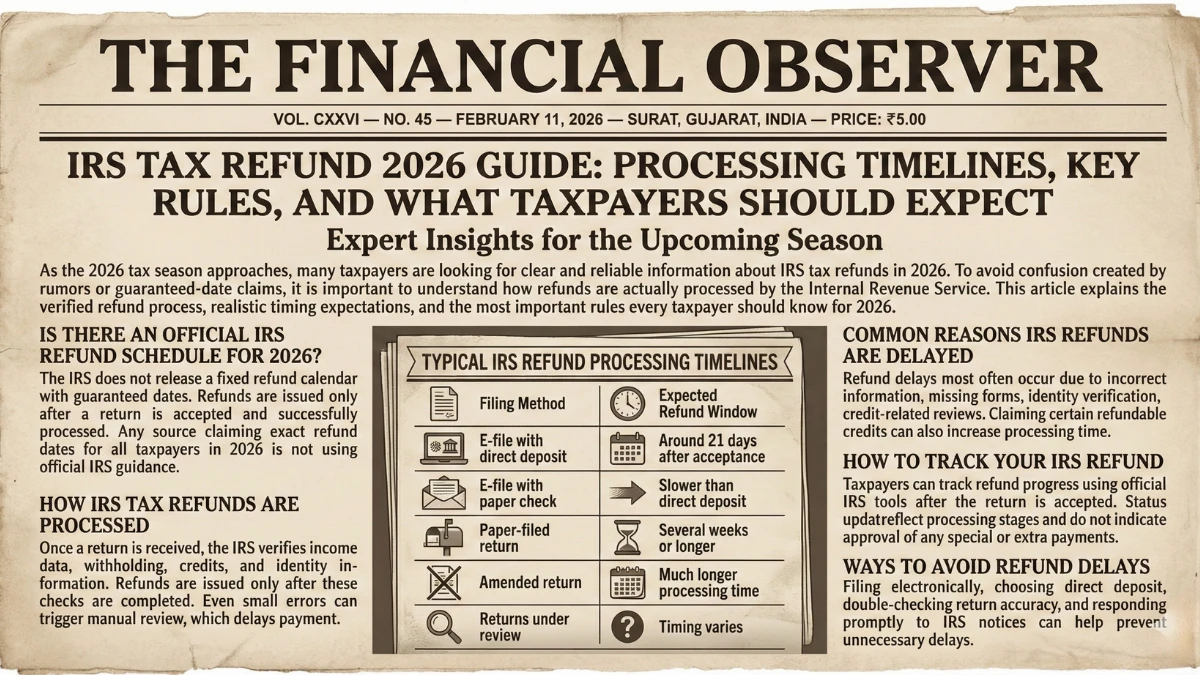

When to Expect the Deposit

The IRS has indicated that payments will be issued mainly during February 2026. While many recipients may see the money arrive quickly, some delays are possible. These delays often affect paper filers, recently amended returns, or accounts that require extra verification. Delays do not necessarily mean ineligibility, but they may require patience while processing is completed.

Steps to Avoid Delays

Keeping bank details and contact information updated with the IRS is essential. Monitoring official IRS tools allows taxpayers to track payment status and identify issues early. Relying only on official government sources helps avoid scams and misinformation.

Final Thoughts on Qualification

Qualifying for the February 2026 $2,000 federal deposit depends on meeting income rules, filing taxes correctly, and maintaining accurate records. Understanding these requirements helps taxpayers prepare and manage expectations during the payment period.

Disclaimer:

This article is for informational purposes only and does not provide financial, tax, or legal advice. Eligibility rules, payment amounts, and deposit timelines may change based on official announcements from the Internal Revenue Service and the U.S. Treasury. Readers should rely on official government sources for the most accurate and up-to-date information.