As the 2026 tax season approaches, many taxpayers are looking for accurate and reliable information about IRS tax refunds. Social media posts and unofficial websites often spread rumors about guaranteed refund dates, which can easily mislead people. Understanding how the refund process actually works can help taxpayers set realistic expectations and avoid unnecessary anxiety during tax season.

Understanding How IRS Refunds Work in 2026

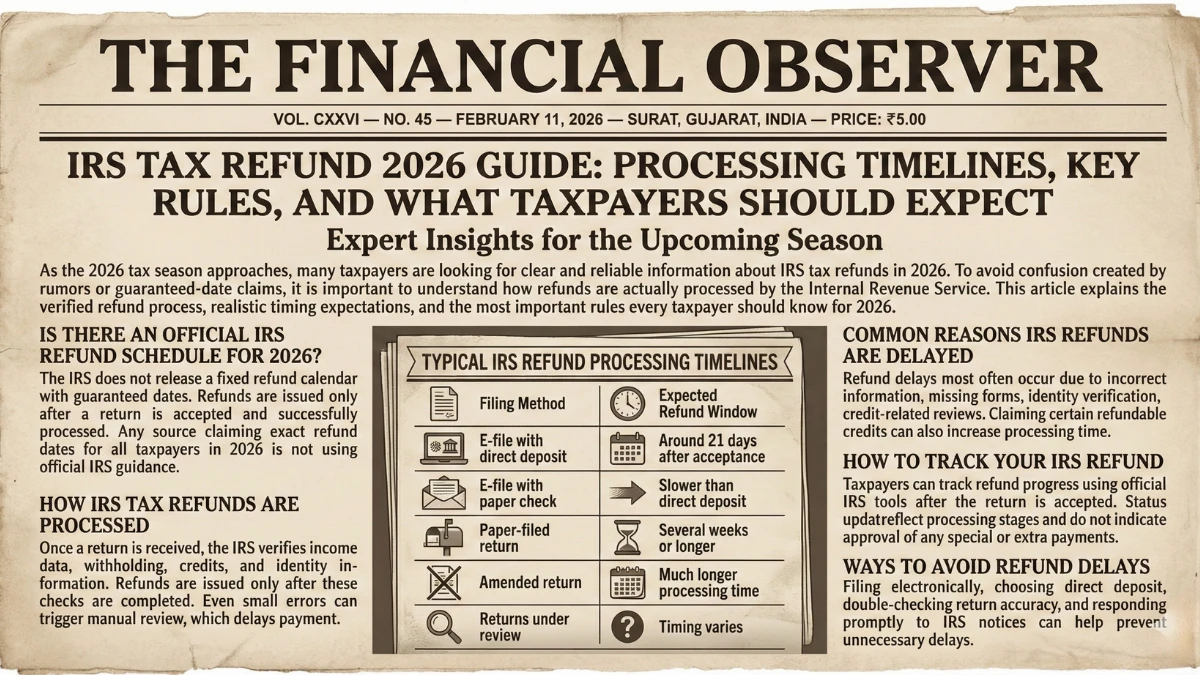

The Internal Revenue Service does not release a fixed refund calendar that applies to everyone. Refunds are issued only after a tax return is filed, accepted, and completely processed. Because every taxpayer’s return is different, refund timing can vary from person to person. Claims about exact refund dates for all taxpayers in 2026 are not based on official IRS information.

What Happens After You File Your Tax Return

Once a tax return is received, the IRS begins a review process. This includes checking reported income, tax withholding, deductions, credits, and identity details. The refund is approved only after all verification steps are completed. Even minor errors, missing forms, or incorrect figures can slow down processing and may require manual review, which extends the waiting period.

Common Reasons Why Refunds Get Delayed

Refund delays are often caused by simple mistakes on the return or mismatched income information. Identity verification requests can also pause the process until the taxpayer responds. Returns that include refundable tax credits usually take longer to process because additional checks are required. These delays are a normal part of the system and are designed to reduce fraud and prevent incorrect payments.

How to Check Your Refund Status Safely

Taxpayers can track the progress of their refund using official IRS tools after their return has been accepted. These tools show whether the return is received, approved, or sent for payment. The status only reflects processing stages and does not indicate bonus payments or special deposits. For accurate updates, taxpayers should rely only on official IRS platforms.

Ways to Receive Your Refund Faster

Filing electronically and selecting direct deposit are the most effective ways to speed up refund delivery. Carefully reviewing the tax return before submitting it helps prevent errors that cause delays. Responding promptly to any IRS notice is also important, as unresolved issues can hold refunds for several weeks or longer.

What to Expect From IRS Refunds in 2026

IRS tax refunds in 2026 will follow standard processing rules, not guaranteed timelines. While many taxpayers receive their refunds within a few weeks, delays can occur for valid reasons. Staying informed about the official process and ignoring online rumors helps taxpayers plan better and remain stress-free during tax season.

Disclaimer:

This article is for informational purposes only and does not constitute tax, legal, or financial advice. IRS refund timelines depend on individual tax filings, verification checks, and official government procedures. For accurate and up-to-date guidance, always refer to IRS.gov or consult a qualified tax professional.